IR35 For Small Business 2025: Back on the Radar for Cost-Savvy Owners

Rising employment costs. Shifting workforce models. A renewed spotlight on compliance.

If you’re running a small business in the UK right now, chances are you’re feeling the pinch. With employment becoming increasingly expensive—from salary expectations to benefits and beyond—it’s no surprise more businesses are exploring contracted services as a leaner, smarter alternative. But before you swap a permanent hire for a contractor, there’s one thing you must understand: IR35.

Let’s open this can of worms—again.

What Is IR35 (And Why Should You Care Now)?

IR35, also known as the off-payroll working rules, is HMRC’s way of identifying “disguised employment”—where a contractor, hired through a limited company (often a Personal Service Company or PSC), is essentially acting like an employee without paying the equivalent taxes. IR35 applies when a contractor is providing services to a client through an intermediary, such as a PSC, rather than working as a genuinely self employed individual. If a contractor is genuinely self employed, IR35 does not apply.

If a contractor is deemed inside IR35, they are taxed as if they were employed. This means income tax, National Insurance contributions (NICs), and PAYE obligations apply, and in many cases, the hiring company becomes responsible for ensuring the correct deductions are made. IR35 does not apply to sole traders or those who are genuinely self employed, as their employment status for tax purposes is assessed differently.

The rules were originally introduced in 2000 but were significantly reformed in 2021 for the private sector. In 2025, as SMEs continue to look for agile, scalable ways to manage talent, IR35 is more relevant than ever.

Why IR35 Matters for Small Businesses in 2025

UK small businesses are increasingly turning to freelancers, independent consultants, and part-time specialists to remain competitive. This allows them to control payroll costs and adapt to fluctuating demand. Many contractors are now affected by IR35 rules, making compliance even more important for businesses.

But failing to understand IR35 obligations can lead to:

Misclassification of employment status

Unexpected tax liabilities and penalties

Loss of talent unwilling to operate under unclear arrangements

Unpaid tax and the risk of penalties from HMRC

HMRC has already begun increasing enforcement. Businesses that ignore IR35 rules—especially those hiring multiple contractors—are likely to face scrutiny. Ensuring compliance is crucial to avoid penalties and legal risks.

The takeaway: Knowing whether a worker is inside or outside IR35 is no longer a nice-to-have. It’s essential.

Determining Employment Status Under IR35

Despite the technical language, IR35 assessments are rooted in common sense. It all comes down to whether the contractor is genuinely independent—or functionally just another employee.

Here are the core criteria HMRC and tribunals will review:

Control – Does the client dictate how, when, and where the contractor performs their work?

Personal Service – Must the contractor carry out the work personally, or can they provide a substitute?

Mutuality of Obligation (MoO) – Is there an ongoing obligation for the client to provide work and the contractor to accept it?

Additional indicators:

Financial risk borne by the contractor

Provision of equipment (yours vs theirs)

Integration into company culture and systems

Business-on-own-account indicators (e.g., own website, insurance, multiple clients)

A written contract helps but isn’t enough. It’s important to regularly review contract terms to ensure they accurately reflect actual working practices. Contractors should also assess their own status by reviewing both contract terms and real-world practices to support their IR35 position. The real-world working practices will be key in any HMRC investigation.

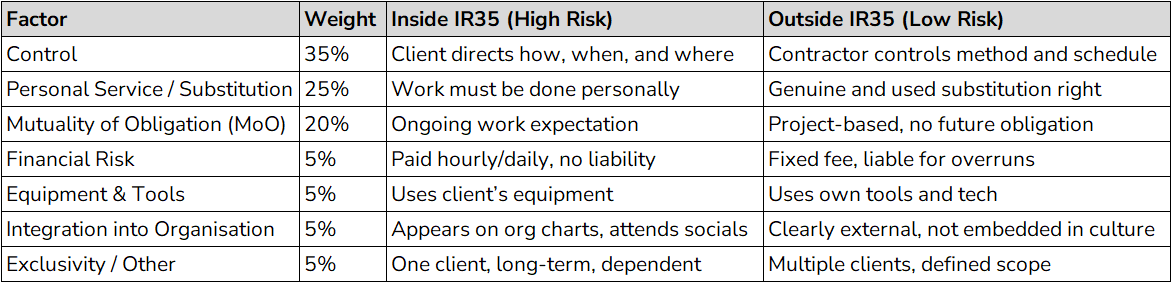

The IR35 Assessment Model: A Practical Framework

To help UK SMEs make defensible decisions, we recommend this scoring-based assessment model:

How to use it:

Score each factor from 0 (clearly outside IR35) to 10 (clearly inside).

Multiply by the weight and total up to 100.

Then assess risk:

0–39: Low risk (likely outside IR35)

40–59: Grey area – proceed with caution and seek legal advice

60–100: High risk (likely inside IR35)

A Quick Example: The Onsite Developer

Let’s say a software developer is contracted for six months, on-site four days a week. They use your laptop, follow your project plan, and while substitution is in the contract, they’ve never used it. They’re also plugged into your systems and canteen.

Score:

Control – 9

Substitution – 6

MoO – 8

Financial Risk – 3

Equipment – 9

Integration – 7

Other – 5

Weighted Total: ~73/100 → High IR35 risk.

Applying the Off-Payroll Rules to Overseas Clients

Does IR35 apply if your contractor works for a foreign client?

That depends. If the client has no UK presence or agency, the contractor remains responsible for their own tax position under the original IR35 rules (pre-2021).

However, the principles are the same: assess status, document the relationship, and understand the tax implications. Contractors working with overseas clients should still perform their own risk assessment using the same model outlined above.

IR35 and the Client: Who Holds the Liability?

Since the 2021 reforms, private sector companies that are medium or large—as determined by their annual turnover, balance sheet total, and employee count—are responsible for assessing IR35 status. A company's size is determined based on figures from the previous financial year, using the filing date as a reference point. Under the current rules, small companies are exempt from this obligation, but the small business exemption does not apply to group companies that are part of a larger group, and that doesn’t make them immune.

Company Size Thresholds:

Annual turnover less than £10.2 million

Balance sheet total under £5.1 million

Fewer than 50 employees

These small company thresholds are assessed using the previous year’s figures. The small business exemption applies when a company meets the small business test and remains within these thresholds for two consecutive years. If your company grows beyond these limits, you must operate PAYE for contractors inside IR35, and IR35 compliance becomes your direct responsibility.

New Thresholds and Forthcoming Changes:From April 2025, new thresholds will come into effect, reclassifying some medium-sized companies as small companies. These forthcoming changes are part of the new rules, and a transitional provision will allow companies time to adjust to the new thresholds and reporting requirements. Under these upcoming changes, end clients and group companies must also consider these thresholds when determining IR35 obligations. Contractors may request confirmation of an end client’s size, and the end client must respond within 45 days. Previous thresholds will be replaced, and the transitional provision ensures a smoother transition for affected businesses.

Chartered accountants can provide expert guidance on interpreting the current rules, upcoming changes, and compliance obligations for end clients, group companies, and contractors.

Why SMEs Should Proactively Manage IR35 Compliance

Waiting until HMRC reaches out is not a strategy. Proactive compliance with payroll working rules positions your business as credible, scalable, and investor-ready.

Benefits of a proactive approach:

Protects cash flow from surprise tax liabilities

Improves negotiation confidence with contractors

Builds trust with external advisors and future partners

Ensures continued access to top freelance talent

Provides access to expert guidance for navigating complex IR35 compliance requirements

You don’t need an army of in-house HR specialists. With the right process and tools, SMEs can handle status determinations in a way that’s efficient and compliant. Proper training for staff involved in IR35 assessments is essential to ensure accurate determinations and compliance. Recent changes also aim to provide more clarity for businesses and contractors regarding IR35 status determinations.

How to Implement an IR35 Strategy in Your Business

Here’s what a smart, scalable IR35 strategy includes:

Policy Development – Create internal guidance on contractor engagement and IR35 assessments. Review responsibilities across the entire supply chain, including recruitment agencies and umbrella companies, to ensure compliance and clarify liability.

Contract Reviews – Align documentation with actual working arrangements and regularly assess obligations throughout your supply chains.

Tool Adoption – Use digital platforms that automate and document assessments.

Training – Equip hiring managers and finance leads with basic IR35 knowledge.

Legal Support – Engage an advisor for grey-area assessments or complex contracts.

Insurance – Consider professional indemnity insurance as an essential part of risk management for contractors and businesses alike.

These strategies help both contractors and businesses alike manage compliance and risk across complex supply chains.

This isn’t about bureaucracy—it’s about resilience. The sooner your business systemises its approach, the faster you de-risk growth.

Final Thoughts: IR35 Isn’t Going Anywhere—And That’s Not a Bad Thing

IR35 exists to create a level playing field—and in many ways, it helps responsible businesses thrive. If you’re willing to plan properly and document your hiring practices, you’re ahead of the curve.

Rather than seeing IR35 as a barrier, think of it as an invitation to build a smarter, leaner, more transparent workforce strategy.

Need help applying the IR35 rules, exploring digital tools to automate assessments, or building this into your contractor onboarding? Let’s talk.

IR35 FAQs for UK Business Owners

Will IR35 go away?

Unlikely. Despite debates and occasional political promises, IR35 has become deeply embedded in HMRC’s approach to tax compliance. The legislation has evolved rather than disappeared. If anything, enforcement will become more sophisticated as workforce models continue shifting.

Is it better to be outside IR35?

From a financial and administrative standpoint—yes. Contractors outside IR35 can retain more income through dividends, while clients avoid added tax responsibilities. That said, it must reflect the true nature of the working relationship. Artificially structuring roles to appear outside IR35 is high risk.

Who decides IR35 status?

For medium and large private sector companies, the hiring company must determine IR35 status. For small companies, the contractor is responsible for their own determination. Either way, clear documentation and structured assessment are key.

What defines a small company under IR35?

According to HMRC, a company is considered small if it meets two of the following: turnover less than £10.2m, balance sheet total under £5.1m, or fewer than 50 employees. The assessment is based on the previous year's figures, the relevant tax year, and the filing date for company accounts.

Do off-payroll working rules apply to all sectors?

Yes. IR35 applies across all sectors in the UK private and public sectors. The key variable is company size, not industry.

What if I get the status wrong?

Misclassification can result in backdated tax, penalties, and interest. HMRC will also look at whether you took reasonable care—using tools, models, or legal advice can help build a defensible position.

What are status determination statements (SDS)?

For medium and large companies, a formal SDS must be issued to the contractor and agency (if applicable), outlining the reasons for the IR35 status decision. This helps ensure transparency and compliance.

Can I appeal an IR35 determination?

Yes. Contractors can challenge determinations they disagree with. Businesses must establish a client-led disagreement process to handle such disputes fairly and promptly. Contractors also have the right to request confirmation of the client's size, and the client must respond within 45 days.

What should be included in an IR35 contract review?

Look for clarity on substitution, control, project deliverables, equipment usage, and termination clauses. Consistency between the written terms and actual working practices is key to standing up in an HMRC inquiry.

Does IR35 apply to sole traders?

No. IR35 does not apply to sole traders. It only applies to individuals providing services through intermediaries, such as personal service companies. When engaging sole traders, the focus is on assessing employment status rather than IR35 compliance.

What happens if a company is not small?

If a company is not small, it must operate PAYE for contractors who are inside IR35. This means the company (or agency acting as fee-payer) is responsible for deducting income tax and National Insurance contributions.

What is the purpose of IR35?

The purpose of IR35 is to ensure that the tax rules are applied fairly, so that individuals working like employees pay broadly the same tax and National Insurance as employees, preventing tax avoidance by disguised employees.

Who is affected by IR35?

IR35 applies to individuals providing services through intermediaries, such as personal service companies, and not to those who are genuinely self-employed or sole traders. Being genuinely self-employed means you operate independently and are not subject to the same off-payroll rules.

How is company size calculated for IR35?

Company size is determined using annual turnover, balance sheet total, and number of employees. The assessment uses figures from the previous year, the relevant tax year, and the filing date for company accounts to establish whether the company meets the small company criteria.

What triggers IR35?

IR35 is triggered when an individual is providing services to a client through an intermediary, such as a personal service company, and the working relationship would otherwise be one of employment if the intermediary did not exist.